Corporate Finance

SimplyFI’s Corporate Finance specialists can help you drive value throughout your acquisition and transaction journey. We combine a global mindset and local / regional experience with deep sector knowledge to help you navigate a complex transaction process.

We provide advice in connection with capital raising and the acquisition and disposal of businesses and on a number of strategic initiatives including debt and capital structure advisory, Islamic finance, corporate structuring, joint ventures, fund placement and financial feasibility studies.

We will help you maximize the value of a business through planning and implementation of resources, while balancing risk and profitability, and to manage your risk/return trade-offs to support you with better decision-making around financing and capital efficiency. We offer deep insights to help you:

- Identify the right asset mix

- Fund/Invest in the right projects

- Predict your future financial performance

- Restructure your current financial standing

- Increase your investor confidence

List of our core Corporate Finance services

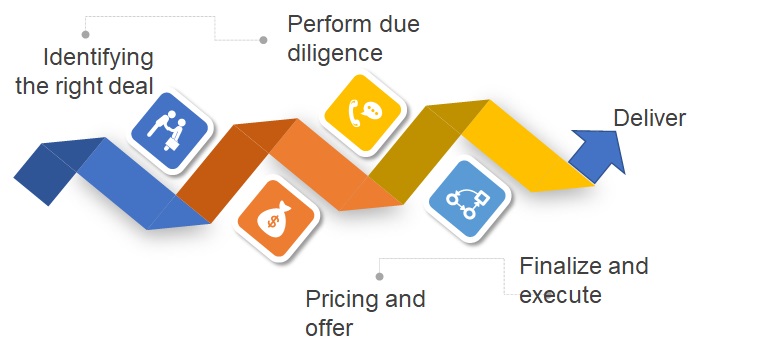

As the deal-making environment in the region becomes ever-more complex, you need an advisor you can trust who has an in-depth understanding of delivering successful deals. Whether you are selling your business, raising capital or acquiring a business, SimplyFI’s corporate finance professionals can help you execute your M&A strategy.

We have an intimate knowledge of the challenges facing organizations across a broad range of markets and industries. We work in close collaboration with you to deliver shareholder objectives and real value from the transaction. We will help you enable strategic growth through better integrated and operationalized mergers and acquisitions, Joint Ventures and alliances. In a fast-paced M&A market, we help companies move quickly to refine their growth strategy, perform deal sourcing, conduct diligence and valuation and achieve greater synergies during M&A integration.SimplyFI can help you understand what business to buy, how to value it and how to integrate it into your company:

- Growth Strategy

- Deal sourcing and origination

- Due diligence and Valuation

- Integration

Valuations are a critical component in the decision-making process for mergers and acquisition transactions, dispute resolutions, corporate restructuring and accounting or financial reporting. In today’s global economy where opportunities exist at every level, it is important that companies have the ability to assess whether these opportunities/transactions are value enhancing or destructive to the business.

SimplyFI provides valuation support to our clients engaged in merger and acquisition activities. Leveraging on our global and regional knowledge, we not only consider characteristics which are specific to a particular sector or country but also consider your strategic objectives for the particular transaction. It is with this specialist knowledge and understanding that enable us to conduct valuations from a commercial perspective.

We offer the following Valuation services, which can help you make an informed decision:

- Fairness Opinions/Independent value analysis on your target or investee companies

- Independent value of specific business units within a company

- Pricing and negotiation support

- Pre-deal Purchase Price Allocation

- Valuation of unquoted companies/financial instruments.

A unified and intuitive financial model can expedite regular processes as well as ad-hoc analyses concerning ongoing decision making, corporate planning and financial reporting. A financial model should be a clear and simple to use, flexibly adaptable and technically clean representation of your business processes and links.

SimplyFI’s structured models translate quantitative and qualitative information to accurately forecast financial outcomes for various business decision. Our financial models are easy to read, and our working procedures, methodologies and quality control frameworks ensure reliable outputs that form basis for fair valuations. Financial models can fulfill different purposes, such as:- Planning and reporting

- Valuation of business and business assets

- Raising Capital

- Financing and investment

- Budgeting and Forecasting

- Risk Management

SimplyFI will support you with verifying you existing financial models and the development of a new financial model

SimplyFI will help you to structure right mix of means of finance, financial analysis, equity rising, and debt raising options like advising company for financial restructuring, merger and demerger to strengthen its fund-raising capability. We advice on the development and financing of critical and complex infrastructure projects. We have experience across the spectrum of infrastructure sectors. We assist a broad range of market participants through the complexities of each stage of a project finance transaction.

With infrastructure high on the global agenda, demand for financing options in developed and emerging economies is increasing. Financing structures are the cornerstone of all public and private infrastructure projects. With a variety of finance options available and changing global trends, our integrated projects lawyers work to ensure that the funding objectives of major projects worldwide are met.SimplyFI will act as an advisor for arranging funds through various types of debt instruments and in strengthening their balance sheets by delivering capital structure alternatives designed for maximum profits. We specifically focus on each service area to improve our service quality based on your needs. We provide you our guidance and expert services to clients based on your need of restructuring in turbulent times or for renewed expansion.

Our restructuring and turnaround services focus on strategic assessment, finance restructuring, working capital improvement, taxation risk and opportunity analysis, cost reduction, capital expenditures and mergers & acquisitions

Our Project Finance and Debt Restructuring portfolio includes:

- Preparation of Project Report & Financial Feasibility Study.

- Term Loan Syndication (Fresh / Refinance).

- Working Capital Facilities.

- Project Financing.

- Structured Finance.

- External Commercial Borrowings.

- Islamic Finance

- Syndicated Borrowings

Contact Us

Our Address

3rd Floor, Bader Business Center

Building 2342, Road 2830, Block 428

Seef, Kingdom of Bahrain

Email Us

Email: contact@simplyfi.me

Call Us

+973-32210515