Transaction services

We provide a range of highly tailored advisory services that span the transaction lifecycle, helping you focus on the key questions at every critical stage.

- Does this deal align to my strategic business objectives?

- Will this deal help me respond to market and competitor dynamics?

- What are the risks and opportunities that will affect value and my negotiating position?

- How do I maximize synergies and add value?

At SimplyFI we see transactions through an investor’s lens and are focused on helping you evaluate and successfully implement your growth strategies in today’s complex business landscape.

List of our core Transaction Services services

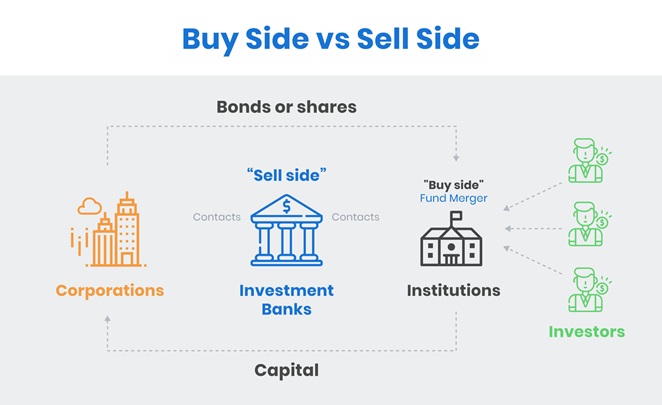

Buy-side due diligence

For the acquiring party, SimplyFI will enhance the purchaser's understanding of the target business and therefore increase the likelihood of the deal being successful by verifying how well financial information reflects the condition of corporate or business. Through financial due-diligence, would-be buyers can help to identify and focus attention on the factors in the business that will be critical to its future success. SimplyFI will help clients to identify and understand critical success factors and therefore improve their understanding of all the relevant issues so that informed decisions can be made.

Sell-side financial due diligence

SimplyFI will provide vendors with greater control over the sale process and the timing of sale, which can help secure a higher price for the business. We reduce disruption to the business as the sale process is more controlled. To ensure an efficient sales process, vendors need to present their financial information to potential buyers as transparently as possible. Our independent professionals provide potential buyers with certainty about the business and the nature of its cash flow.

SimplyFI’s Commercial due diligence tests the information that informs a client’s M&A deal valuation and post-merger acquisition plan. We can validate a target company’s recurring revenue, revenue growth, and margin sustainability, as well as conduct rapid primary research on its markets, customers, suppliers, and competitors. Acquiring Companies often have only weeks to decide whether to make an offer, and an important decision factor is whether they believe a target company’s claims about its position in the marketplace, financial stability, and hypotheses about future growth potential.

Our Commercial Diligence services include:

- Testing important inputs to the deal valuation

- Sizing markets

- Testing the competitive position of the target

- Testing for deal synergies

- Operational diligence

SimplyFI’s Vendor due diligence will help with presenting clear and concise financial and non-financial information to potential buyers which will enable an efficient sales process for the vendor/seller. We can provide comprehensive, objective assessment of the positioning and prospects of a subsidiary, business unit, or line of business. The process creates a compelling story line and enables potential buyers to jump-start their own due diligence processes

SimplyFI’s Transaction Services deploys a customized process—to complement the standard vendor due diligence checklist—that includes:

- Assessing market attractiveness, margins, growth, market share, and related areas

- Reviewing the asset’s strategy and potential paths forward

- Validating the business plan rigorously and objectively

- Collecting and developing supporting information

- Preparing a scenario-based financial model

Contact Us

Our Address

3rd Floor, Bader Business Center

Building 2342, Road 2830, Block 428

Seef, Kingdom of Bahrain

Email Us

Email: contact@simplyfi.me

Call Us

+973-32210515